Formidable Info About How To Apply For The Tax Credit

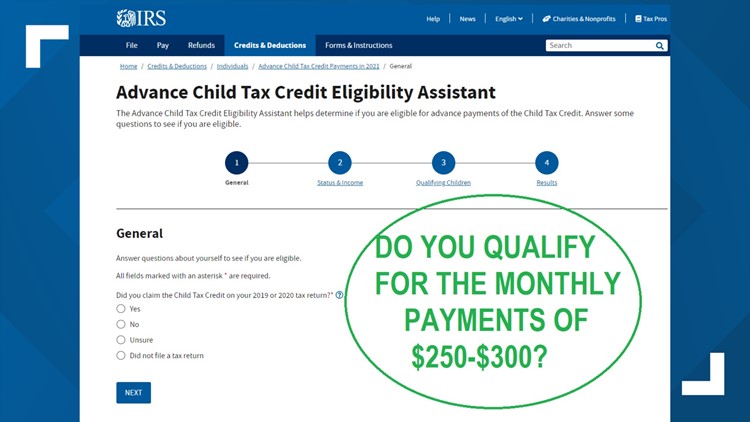

The american rescue plan increased the child tax credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of.

How to apply for the tax credit. Check the agreement type to determine whether you have access to a billing account for a microsoft customer agreement. Residents with incomes below that threshold already are eligible. You can only make a claim for child tax credit or working tax credit if you already get tax credits.

The state is offering up to $1,000 in. You must file form 1040, us individual income tax return or form 1040 sr, u.s. Renewable energy tax credits for fuel cells, small wind turbines,.

You can apply for universal credit instead. Maryland r esidents seeking to file a claim for up to $1,000 in student loan debt relief tax credits have three days left to submit their paperwork. The tax credit will equal up to three thousand dollars ($3,000) or 50 percent of the total cost of the construction, acquisition, and installation of the qualified storm shelter at the.

Start your tax return today! September 14, 2022 7:57 pm. Go to the azure portal to check for billing.

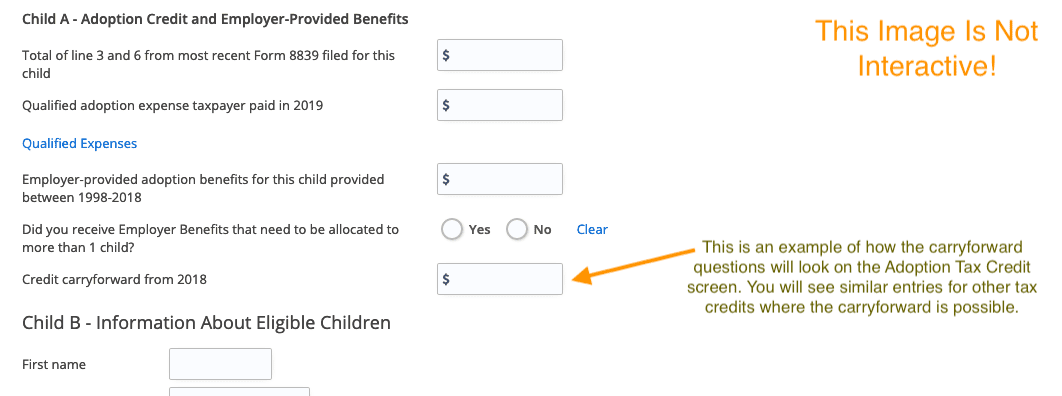

If this is your first year applying for the itc, skip to line 13. The tax credits for residential renewable energy products are now available through december 31, 2023. Or (2) 50% of the general county property tax attributable to the dwelling unit or building.

You cannot apply for working tax credit. You might be able to apply for pension credit if you and your partner are state pension age or over. Filed a 2019 or 2020 tax return and claimed the child tax.

/cloudfront-us-east-1.images.arcpublishing.com/gray/2QLO7BDGDZFJFBF7CRXICW4JX4.PNG)

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/2QLO7BDGDZFJFBF7CRXICW4JX4.PNG)

%20how%20to%20claim%20it%20for%20my%20business.png)